How Millennials and Gen Z Consumers Are Changing the Dry Fruits Market

How Millennials and Gen Z Consumers Are Changing the Dry Fruits Market

Walk into any modern retail store or scroll through a health and wellness influencer’s shopping haul – and chances are, you will spot roasted makhanas, chia seed trail mix, or chocolate-coated almonds tucked-in neatly next to protein bars.

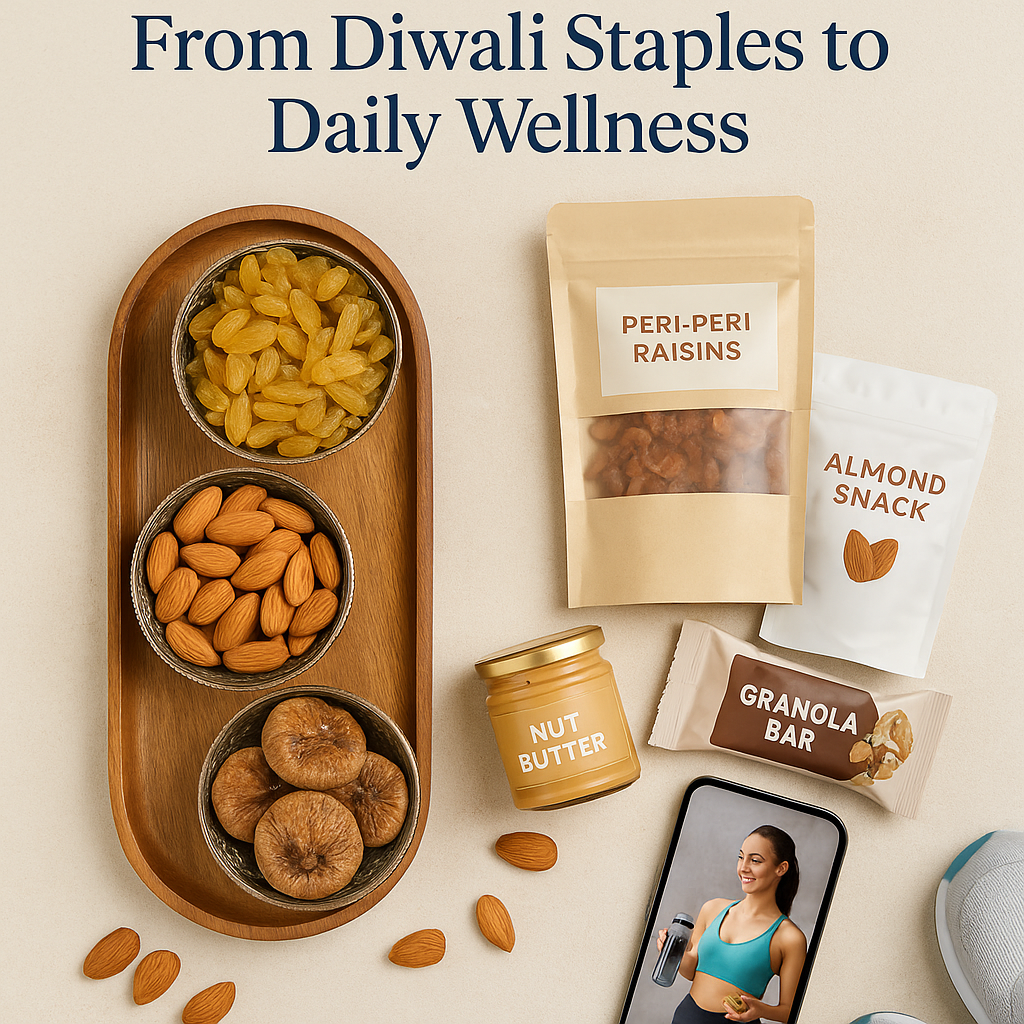

Nuts and Dry Fruits are no longer staples in Diwali-special cupboards. They are becoming an everyday essential, and a huge reason in this shift is the rising influence of Millennials and Gen Z consumer base.

From Tradition to Trend: What’s Driving the Change?

Today’s younger consumers aren’t just health-conscious – they are active label-readers, snackers, and storytellers. They want food that’s functional, fun, and Instagrammable. And dry fruits, it turns out, just fit the bill.

A study by Innova Market Insights showed that 60% of Gen Z consumers globally mention that they actively seek healthier snack alternatives (Innova, 2023). Closer home, IMARC Group projects that India’s dry fruit market will grow at a CAGR of 6.7% between 2022-2033, with urban demand, especially from younger buyers, being a major growth driver.

What’s Changing on the Ground?

Here’s a snippet of what brands and importers are already adapting to:

- Flavour is King

No longer limited to plain almonds or raw figs, today’s shelves feature peri-peri raisins, rose-flavoured cashews, paan pistachios, and even saffron dates. Customisation and flavour innovation are the key to keeping Gen Z interested.

- Packaging Matters

Minimalist, resealable, travel-friendly, and eco-conscious packaging isn’t a luxury anymore – it’s expected. Millennials’ grab-and-go lifestyle is driving the shift towards “snack pack” and single-serve convenience pouches.

- Value Addition is the Real Hero

Value-added products like nut butters, granola bars, and breakfast bowls featuring dry fruits are exploding in the Indian market. Brands that offer convenience without compromise are winning Gen Z customers’ loyalty – a key agenda also supported by the Ministry of Food Processing Industries, Government of India.

- Price-Sensitive, But Purpose-Driven

What makes this shift especially interesting is how price-sensitive but purpose-driven younger buyers are. They’re willing to pay a premium – but only if the products reflect quality, transparency, and ethical sourcing – values promoted by FSSAI – Food Safety and Standards Authority of India.

In fact, a 2024 report by Deloitte India noted that 56% of Indian millennials and Gen Z consumers prefer buying from brands that align with their values, including sustainability and fair trade.

What It Means for the Industry

If you’re in the nuts and dry fruits business and still viewing makhana, almonds, or anjeer as seasonal inventory, it may be time to rethink.

Nuts and Dry Fruits Council (India), under the leadership of Gunjan Jain and Col Nitin Sehgal, believes that the sector stands at a powerful confluence where consumer behaviour and health trends are converging.

For businesses, this is the time to explore:

- Premium packaging formats

- Retail-ready value-added products

- Direct-to-consumer innovations

- Gen Z-friendly storytelling and branding

With institutional support from stakeholders like FSSAI, Legal Metrology India, APEDA, NABARD, ICMR-NIN, and The World Bank, the time is ripe to future-proof your nuts and dry fruits strategy.

Millennials and Gen Z are not just consuming more dry fruits – they’re redefining what the category means. From a symbol of festivity to a staple of modern wellness, the journey has just begun.

If you’re a stakeholder in the dry fruits ecosystem, there’s never been a better time to plug into this evolving united voice of the industry – Nuts and Dry Fruits Council (India).

Join Nuts and Dry Fruits Council (India) and be a part of a future-forward community that understands where the industry is headed – and helps shape it. Become a member today: Join us